In my last post, I stated that I would write about the one thing that every venture capitalist wants to see in a new venture. Initially, I had every inclination of a prompt response. However, I soon discovered that the answer to the question was not so "cut and dry. "

I did some research and found a lot of cookie cutter speculation in many blogs, magazines and publications. But, I did not want to take this lame approach, so instead, I conducted my own research and called some VC's to get their response. Here are the results:

After surveying 100 VC'c and three weeks later, My results were... there was not a clear cut answer. In this case, some VC's said ROI or Management Team, or traction, but nothing conclusive.

Often times in research we want one thing to put our finger on one thing and have that "Ah ha" moment but in realty, real world research does not always demonstrate any significance of one factor over another.

This is why I think there is so much speculation about this topic because people sell they claims/opinions as if it is fact to desperate business owners looking for investors. However, I would rather keep my integrity and give you the cold facts.

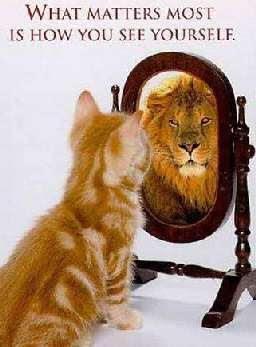

Nevertheless, my research was not in vain. After talking with a couple of VC's, they did elude to one trait that I think is worth mentioning. They all stated that they had no emotional attachment to a business and what the liked from the owner was confidence.

Not the type of confidence that you see at the bar from desperate old men trying to pick up 21 year olds, but the type of business confidence that comes with communicating how the VC is going to get their money back. This is something we can build on.

So here is the question, "what is a good way to practice speaking to convey confidence?" In my next post I will address this answer.

NaShawn

PS If you have something you want me to address, drop me a line.